Technical analysis presents a variety of trading indicators and tools to assist in determining trends and predicting reversals. Aside from technical indicators, the candlesticks patterns are an excellent way to analyze market action.

As you may be aware, there are numerous methods for displaying the historical price of an asset, whether it is a currency pair, a company share, or a cryptocurrency. Line charts, bar charts, and candlestick charts are the three most common chart kinds. The candlestick chart is used by most traders because it can show a variety of patterns that predict trend reversals or continuations with a high degree of accuracy.

Over time, traders saw that when certain patterns preceded price changes on the candlestick chart, they moved in identical ways. As a result, they separated these patterns and classified them for use as technical analysis tools. But what exactly is a candlestick?

Candlesticks in Trading: How Do They Work?

By far the most complete graphic style for depicting an asset’s price is the candlestick chart. This sort of graphic was taken by cryptocurrency traders from stock and FX trading. Unlike the line chart, which simply shows the close price, the candlestick chart’s structure provides a wealth of information regarding historical prices.

Also Read: All You Need to Know About Primary and Secondary Markets in Crypto Trading

Candlesticks form sequentially one after the other and can help you see the overall trend as well as resistance and support lines even if you don’t have any technical indicators. Furthermore, they can exhibit particular patterns that operate as buy or sell indications. The candlestick chart is particularly useful for cryptocurrencies, which are very volatile and necessitate comprehensive technical analysis.

The 16 Most Popular Candlesticks Patterns

While there are several candlestick patterns, we’ll focus on the most common and trustworthy ones, beginning with bullish patterns, which appear after a decline and predict an upward turnaround. When these patterns develop, cryptocurrency traders typically open long positions.

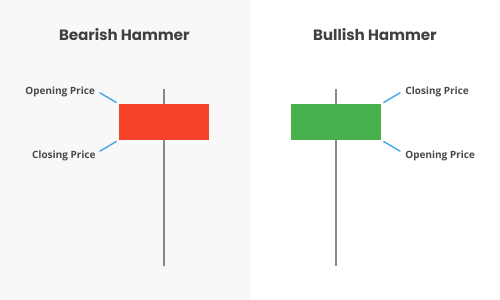

Hammer

The hammer candlestick has a short body with a significantly longer lower shadow. The candlestick is nicknamed a hammer pattern because it resembles an upright hammer. The hammer is usually found near the bottom of a downtrend. This pattern implies that bulls have resisted selling pressure and pushed the market back up during a certain period. While both green and red candles can create hammer formations, green hammers indicate a stronger uptrend than red hammers.

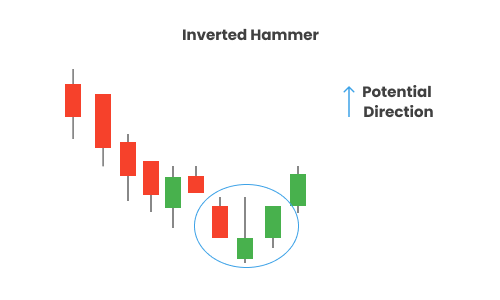

- Inverted Hammer

The inverted hammer pattern is identical to the conventional hammer pattern, except it has a much longer upper shadow and a very short lower wick. This pattern indicates buying pressure followed by failed bear attempts to pull the market down. As a result, buyers apply even more pressure, pushing prices higher.

- Bullish Engulfing

In contrast to the previous two patterns, the bullish engulfing is composed of two candlesticks. The initial candle should have a short red body and be consumed by a larger green candle. While the second candle begins lower than the preceding red candle, buying pressure grows, resulting in a downtrend reversal.

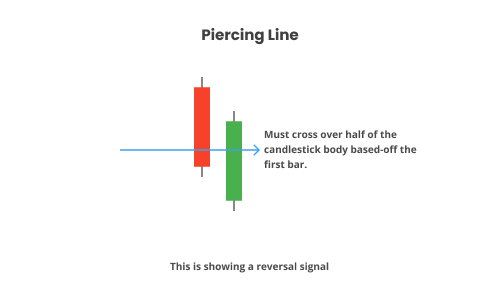

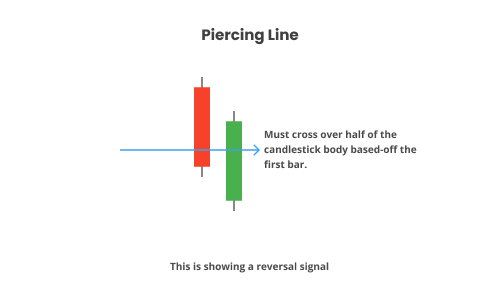

- Piercing Line

The piercing line is another two-candlestick pattern that may appear at the bottom of a downtrend near the support level, or during a pullback with the expectation of a positive movement. A long red candle is followed by a long green candle to form the pattern. The essential component of this pattern is the large difference between the closing prices of the red and green candles. In addition, the close should be at least half the length of the previous day’s red candlestick body. The fact that the green candle ends substantially higher than the open indicates that there is strong purchasing demand.

- The Morning Star

Morning star patterns are more difficult because they include three candlesticks: a long red candle, a short-bodied candle, and a long green candle. The morning star pattern indicates that the selling pressure from the first period is waning and that a bull market is beginning.

- Three White Soldiers

The three white soldiers are another three-stick candle. It consists of three tall green candles in a row, with very brief shadows. The main requirement is that three successive greens open and shut higher than the preceding session. This pattern is considered a strong bullish signal that appears after a downtrend.

- The Hanging Man

A green or red candlestick with a short body and a lengthy bottom shadow forms the hanging guy. It often comes toward the end of an uptrend and indicates that a significant sell-off is imminent, but bulls may temporarily push prices higher before losing control.

- The Shooting Star

An inverted hammer is the inverse of a shooting star. It is made up of a red candle that has a short body and a long top shadow. In general, the market will gap slightly higher on the candlestick opening and explode to a local high before closing close below the open. The body might be almost non-existent at times.

- Bearish Engulfing

The bearish engulfing pattern is the inverse of the bullish engulfing pattern, with the first candle having a little green body and being totally covered by the following lengthy red candle. This pattern appears at the apex of an uptrend and indicates a reversal. The lower the second candle stays, the stronger the negative move will be.

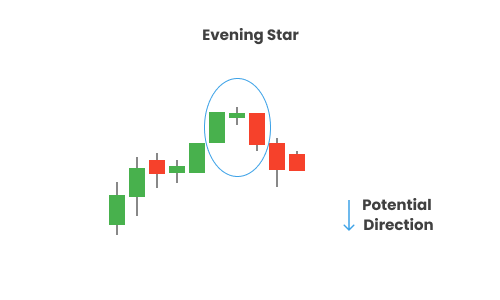

- The Evening Star

The evening star is a particular three-stick arrangement. It is made up of a short-bodied candle that sits between a long green candle and a large red candle that shuts below the first green candle’s middle. This pattern appears at the top of an uptrend and indicates a possible reversal.

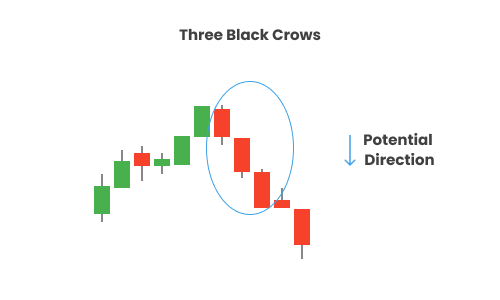

- Three Black Crows

Three long straight reds with short or virtually nonexistent shadows make up the three black crows’ motif. Every new candle begins at roughly the same price as the previous one, but each close substantially lower. It is considered a strong bearish signal.

- Dark Cloud Cover

The dark cloud cover pattern is like the piercing line; however, it is the inverse of it. It foreshadows a bearish reversal and consists of two candlesticks: a red candle that opens above the previous green body and closes below its midpoint, and a blue candle that opens below its midpoint. This pattern indicates that bears have taken control of the market and are driving down prices. If the candle shadows are short, traders might predict a significant downturn.

Aside from the bullish and bearish patterns that predict trend reversals, there are also candlestick patterns that are neutral or indicate the continuation of a trend, whether bullish or bearish.

Among them are the following:

- Doji

- Spinning Top

- Three Falling Methods

- Rising Three Techniques

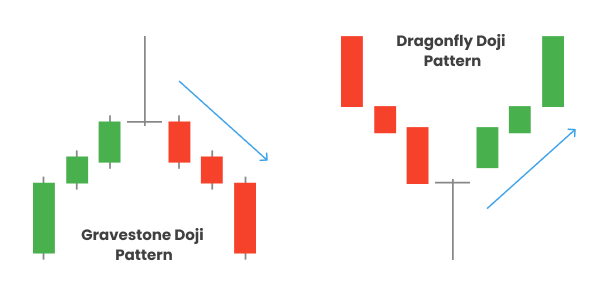

- Doji

The doji candlestick has a very small body and a very lengthy shadow. While it is commonly seen as a trend continuation pattern, traders should be cautious because it may also indicate a reversal. When the situation becomes evident, open a few candles following a doji to avoid confusion.

- Spinning Top

The spinning top, like doji, is a candlestick with a short body. The two shadows, however, are of equal length, with the body in the middle. This pattern also denotes indecision and may signify a time of rest or consolidation following a major rally or price decrease.

- Three Falling Methods

A falling three methods pattern is made up of five candles arranged in a certain way that indicates the continuance of a downtrend. It is made up of a long red body, three little successive green bodies, and another long red body. The bodies of the green candles are all covered by bearish reds, indicating that the bulls lack the capacity to reverse the downtrend.

- Rising Three Techniques

The rising three techniques pattern, which is the inverse of the previous one, can be seen during uptrends. The pattern consists of a long green candle, three small red candles, and another long green candle.

The Advantages of Using Candlestick Patterns

Candlestick patterns provide bitcoin traders with more information about anticipated future moves. In other words, they serve as signals, assisting traders in determining when to start long or short positions, as well as when to enter or depart the market. Swing traders, for example, use candlestick charts as swing trading indicators to predict reversal and continuation trading patterns. Candlestick charts and patterns assist traders in determining trends, understanding momentum, and determining current market mood in real time.

Last Thoughts

Candlestick patterns should be in the toolbox of any cryptocurrency trader, especially crypto day traders, because they perform similarly to the forex and stock markets. While these patterns can provide important individual trade signals, we advocate combining them with technical analysis indicators to confirm or invalidate them.

To stay updated about everything related to trading, keep an eye on Freedom.